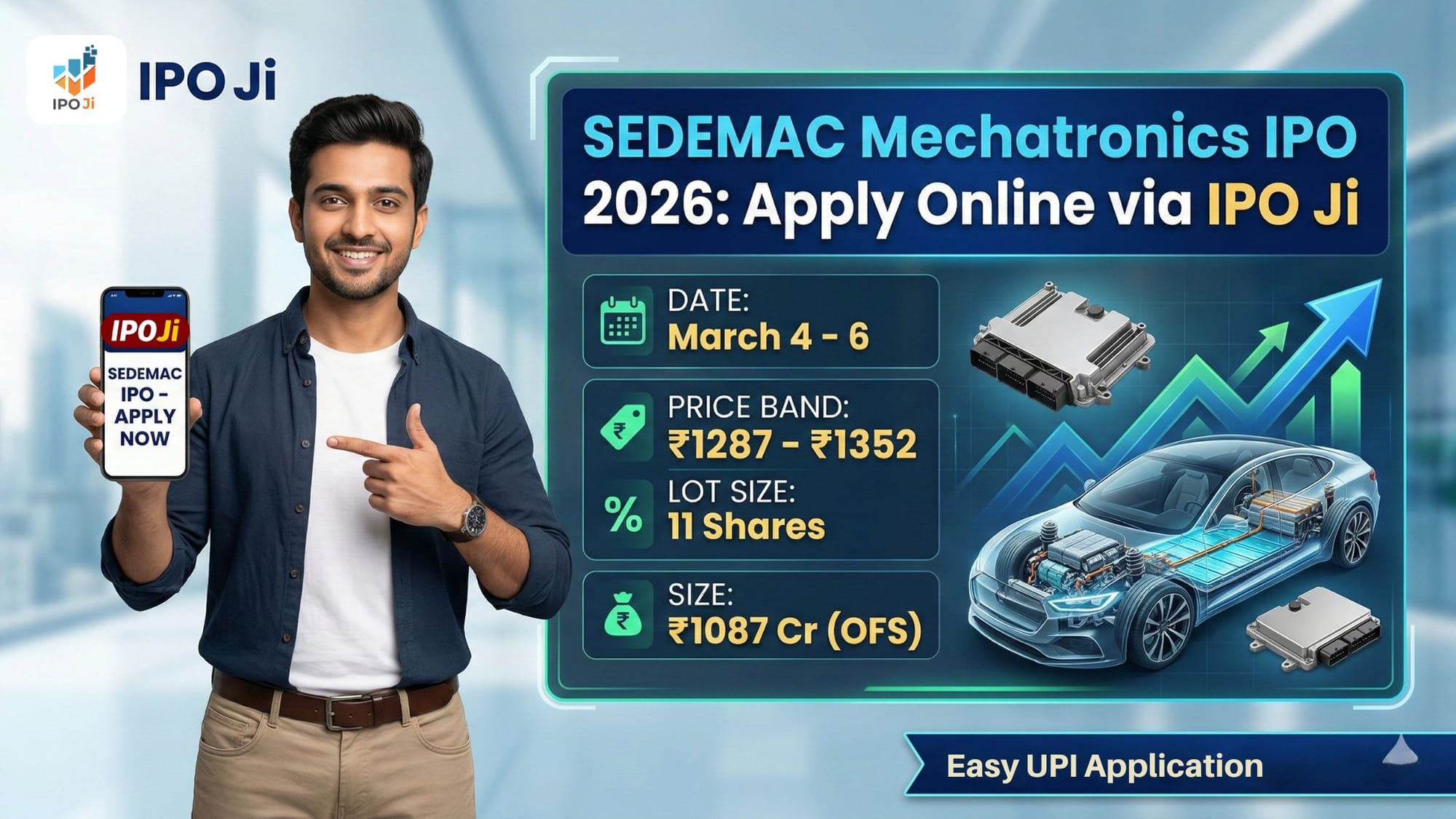

How to Apply for IPO Online in 2025: Complete Step-by-Step Guide

Applying for an Initial Public Offering (IPO) has never been easier. With the rise of mobile apps and UPI payments, Indian investors can now apply for IPOs in just 2 minutes from their smartphones. Whether you're a first-time investor or experienced trader, this comprehensive guide will show you exactly how to apply for IPO online in 2025 using the easiest methods available.

In this guide, you'll learn three different methods to apply for IPOs, compare their pros and cons, and discover the fastest way to submit your application. We'll also cover common mistakes to avoid and tips to increase your allotment chances.

What is IPO Application?

IPO application is the process of bidding for shares when a company goes public for the first time. When you apply for an IPO, you're essentially placing an order to buy shares at the offer price before they start trading on stock exchanges like NSE and BSE.

Key points about IPO application:

- You need a Demat account to hold shares

- Minimum investment starts from ₹10,000-₹15,000 (one lot)

- Application money is blocked until allotment

- Allotment is done through lottery if oversubscribed

- Shares are credited to your Demat account after listing

3 Ways to Apply for IPO in India (2025 Comparison)

There are three main methods to apply for IPOs in India. Here's a detailed comparison to help you choose the best option:

Method | Time Required | Ease of Use | Cost | Best For |

|---|---|---|---|---|

IPO Ji App ⭐ | 2 minutes | Easiest | Free | Everyone (Recommended) |

Broker App | 5-10 minutes | Moderate | Free | Existing broker users |

Bank Net Banking | 15-20 minutes | Complex | Free | Traditional investors |

Our Recommendation: For the fastest and easiest IPO application experience, we recommend using the IPO Ji app. With over 25 lakh downloads and a 4.9-star rating, IPO Ji simplifies the entire process and lets you apply for IPOs in just 2 minutes.

Method 1: How to Apply for IPO Using IPO Ji App (EASIEST METHOD)

IPO Ji is India's #1 IPO application platform trusted by over 25 lakh investors. Here's how to apply for any IPO using the IPO Ji app:

Prerequisites Before You Start

Make sure you have:

- ✅ Active Demat account (from any broker - Zerodha, Groww, Angel One, Upstox, etc.)

- ✅ UPI ID linked to your bank account

- ✅ PAN card

- ✅ Sufficient funds in your bank account

Step 1: Download IPO Ji App

Download IPO Ji from Google Play Store or Apple App Store. The app is completely free with no hidden charges.

Download Links:

- Android: Download from Play Store

- iOS: Available on App Store

Step 2: Browse Upcoming IPOs

Open the IPO Ji app and browse through all upcoming mainboard and SME IPOs. Each IPO listing shows:

- IPO open and close dates

- Price band and lot size

- Expected premium (GMP)

- Live subscription status

- Company details and financials

Step 3: Select the IPO You Want to Apply For

Tap on any IPO to view complete details. Review the company information, subscription data, and GMP before deciding to apply.

Step 4: Click "Apply Now" Button

Once you've decided to apply, click the "Apply Now" button on the IPO details page.

Step 5: Add Your Demat Account Details

If applying for the first time, you'll need to add your Demat account details:

- Demat account number (16-digit DP ID + Client ID)

- PAN card number

- UPI ID

Pro Tip: IPO Ji allows you to save multiple Demat accounts, so you can apply for IPOs for yourself, family members, and friends—all from one app!

Step 6: Enter Bid Details

Choose your bid parameters:

- Bid Price: Selected automatically at cutoff.

- Quantity: Select number of lots (minimum 1 lot)

- Category: Retail (for investments up to ₹2 lakh)

The app automatically calculates the total amount required.

Step 7: Authorize UPI Payment

After submitting your bid, you'll receive a UPI mandate request on your UPI app (Google Pay, PhonePe, Paytm, etc.).

Important: The money is only blocked in your account, not debited. It will be unblocked if you don't get allotment.

Step 8: Track Your Application Status

Once applied, you can track:

- Live subscription status (how many times the IPO is subscribed)

- Expected allotment chances

- Allotment status (after IPO closes)

- Listing date and price

Total Time Required: 2-3 minutes!

Method 2: How to Apply for IPO Through Broker Apps

If you already use broker apps like Zerodha, Groww, Angel One, or Upstox, you can apply for IPOs directly through their platforms.

General Steps for Broker Apps:

- Open your broker app (Zerodha Kite, Groww, Angel One, etc.)

- Navigate to the IPO section

- Select the IPO you want to apply for

- Enter bid details (price, quantity, UPI ID)

- Submit application

- Approve UPI mandate

Pros: Convenient if you already use the broker

Cons: Limited to one Demat account, less detailed IPO information, no GMP updates

Method 3: How to Apply for IPO Through Bank Net Banking (ASBA)

The traditional ASBA (Application Supported by Blocked Amount) method allows you to apply through your bank's net banking portal.

Steps for Net Banking Application:

- Log in to your bank's net banking

- Go to "Invest" or "IPO" section

- Select the IPO from the list

- Enter Demat account details

- Fill bid details (price, quantity)

- Submit application

- Amount gets blocked in your account

Pros: No need for third-party apps

Cons: Time-consuming, complex interface, limited IPO information, no real-time updates

UPI vs ASBA: Which Payment Method is Better?

Feature | UPI Method | ASBA Method |

|---|---|---|

Application Time | 2-3 minutes | 15-20 minutes |

Ease of Use | Very Easy | Complex |

Mobile Friendly | Yes | Limited |

Fund Blocking | Instant | Takes time |

Mandate Limit | ₹5 lakh per day | No limit |

Best For | Retail investors | HNI investors |

Recommendation: For retail investors applying for up to ₹2 lakh, UPI is the best method. It's faster, easier, and works seamlessly with mobile apps like IPO Ji.

Common Mistakes to Avoid When Applying for IPO

Avoid these mistakes to ensure your IPO application is successful:

1. Applying on the Last Day

Don't wait until the last day! Technical issues, server problems, or UPI failures can cause your application to fail. Apply on Day 1 or Day 2 of the IPO.

2. Wrong Demat Account Details

Double-check your 16-digit Demat account number (DP ID + Client ID). Even one wrong digit will reject your application.

3. Insufficient Bank Balance

Ensure you have sufficient funds in your bank account before applying. The amount gets blocked immediately.

4. Not Approving UPI Mandate

After submitting your application, you must approve the UPI mandate within the time limit. Check your UPI app notifications!

5. Applying for Multiple Lots in Retail Category

For retail category (up to ₹2 lakh), applying for multiple lots doesn't increase your chances. It's better to apply from multiple Demat accounts (family members).

6. Ignoring Subscription Data

Check live subscription numbers before applying. Highly oversubscribed IPOs (20L+ retail) have very low allotment chances. Use IPO Ji's competition indicator to identify better opportunities.

7. Not Checking GMP

Grey Market Premium (GMP) indicates market sentiment. Negative GMP means the IPO might list below issue price. Check GMP on IPO Ji before applying.

8. Applying Without Research

Don't apply blindly! Review company financials, PE ratio, promoter holding, and issue objectives before investing.

How to Check IPO Application Status

After applying for an IPO, you can check your application and allotment status through multiple methods:

Method 1: Using IPO Ji App (Easiest)

Open IPO Ji app → Go to "My Applications" → View status of all your IPO applications in one place. IPO Ji automatically checks allotment status from all registrar websites.

Method 2: Registrar Website

Visit the registrar's website (Link Intime, KFin Technologies, etc.) and enter your PAN or application number to check status.

Method 3: NSE/BSE Website

Check application status on NSE or BSE official websites using your PAN card number.

Tips to Increase Your IPO Allotment Chances

While IPO allotment is primarily lottery-based for oversubscribed issues, these tips can improve your chances:

1. Apply Early (Day 1)

Applying on the first day ensures your application is processed without technical glitches.

2. Use Multiple Demat Accounts

Apply from your own, spouse's, parents', and children's Demat accounts. Each application is treated separately in the lottery.

3. Target Low Competition IPOs

IPOs with lower retail subscription (under 5 lakh applications) have higher allotment chances. IPO Ji shows a competition indicator to help you identify these opportunities.

4. Apply at Cut-Off Price

Always select "cut-off price" instead of entering a specific price. This ensures your bid is considered even if the final price is at the upper band.

5. Apply for Full Lot Only

In retail category, applying for 1 lot gives the same allotment chance as applying for 13 lots. Save your capital for multiple IPOs instead.

6. Monitor Subscription Data

Check live subscription numbers on IPO Ji. If retail subscription crosses 20 lakh by Day 2, your allotment chances drop significantly.

7. Focus on Quality, Not Quantity

Apply only for fundamentally strong companies with good financials and reasonable valuations. Check PE ratio, revenue growth, and promoter credibility.

How Long Does IPO Application Take?

The entire IPO application process timeline:

- Application submission: 2-3 minutes (using IPO Ji app)

- UPI mandate approval: Instant to 1 hour

- IPO subscription period: 3 days (some IPOs are 1-2 days)

- Basis of allotment: 3-4 days after IPO closes

- Refund process: 1-2 days after allotment

- Share credit to Demat: 1 day before listing

- Listing day: 5-7 days after IPO closes

Total timeline from application to listing: 10-12 days

What Happens After You Apply for IPO?

Here's the complete journey after you submit your IPO application:

- Money Blocked: Your application amount is blocked in your bank account (not debited)

- Subscription Period: IPO remains open for 3 days for all investors to apply

- Basis of Allotment: After IPO closes, the registrar conducts lottery for oversubscribed categories

- Allotment Status: Check if you received shares or not (usually 3-4 days after close)

- Refund: If not allotted, money is unblocked within 1-2 days

- Share Credit: If allotted, shares are credited to your Demat account

- Listing Day: Shares start trading on NSE/BSE, and you can sell for profit

IPO Application Charges and Fees

Good news! Applying for IPOs is completely FREE in India. There are no application charges, processing fees, or hidden costs.

What you pay:

- Only the IPO share price × number of shares

- No brokerage, no fees, no charges

What brokers/apps charge:

- IPO Ji: 100% FREE (no charges for IPO application)

- Zerodha: FREE

- Groww: FREE

- Angel One: FREE

You only pay brokerage when you sell the shares after listing, not during application.

Can I Apply for IPO Without a Demat Account?

No, you cannot apply for IPO without a Demat account. A Demat account is mandatory to hold shares in electronic form.

How to open a Demat account:

- Choose a broker (Zerodha, Groww, Angel One, Upstox, etc.)

- Complete online KYC with PAN, Aadhaar, and bank details

- Account opens in 24-48 hours

- Start applying for IPOs!

Pro Tip: Open Demat accounts with multiple brokers for yourself and family members. This allows you to apply for the same IPO from multiple accounts, increasing your allotment chances.

Frequently Asked Questions (FAQs)

1. What is the minimum amount required to apply for IPO?

The minimum amount varies by IPO, typically ranging from ₹10,000 to ₹15,000 for one lot. The exact amount depends on the IPO price band and lot size.

2. Can I apply for IPO from multiple Demat accounts?

Yes! You can apply from multiple Demat accounts as long as each account has a different PAN card. Apply from your own, spouse's, parents', and children's accounts.

3. How do I know if I got IPO allotment?

Check allotment status on IPO Ji app, registrar website, or NSE/BSE website 3-4 days after the IPO closes. You'll also receive an email and SMS notification.

4. What is cut-off price in IPO?

Cut-off price means you're willing to pay whatever final price is decided within the price band. Always select cut-off price to ensure your bid is considered.

5. Can I cancel my IPO application?

Retail bids can be cancelled, but there is no provision to cancel the HNI bids. If mandate is already accepted, the money remains blocked until allotment or refund.

6. What happens if I don't get IPO allotment?

If you don't get allotment, the blocked amount is automatically unblocked and returned to your bank account within 1-2 days.

7. Is it safe to apply for IPO through apps?

Yes, it's completely safe. Apps like IPO Ji use secure UPI payment gateways and never store your banking credentials. Your money goes directly to the IPO escrow account.

8. Can I apply for IPO on the last day?

Yes, but it's not recommended. Apply on Day 1 or Day 2 to avoid technical issues, server overload, or UPI failures on the last day.

9. What is GMP in IPO?

GMP (Grey Market Premium) is the expected listing premium over the issue price. Positive GMP indicates strong demand, while negative GMP suggests weak sentiment.

10. How many IPOs can I apply for at once?

You can apply for unlimited IPOs as long as you have sufficient funds in your bank account for each application. The amounts are blocked separately.

11. Do I need to pay brokerage for IPO application?

No! IPO application is completely FREE. You only pay brokerage when you sell the shares after listing.

12. What is the best time to apply for IPO?

Apply on Day 1 or Day 2 of the IPO subscription period. This gives you time to resolve any technical issues and ensures your application is processed smoothly.

13. Can NRIs apply for IPO?

Yes, NRIs can apply for IPOs through the NRI category using their NRE/NRO Demat accounts. The process is similar but requires NRI-specific documentation.

14. What is retail category in IPO?

Retail category is for individual investors applying for up to ₹2 lakh per IPO. At least 35% of IPO shares are reserved for retail investors.

15. How is IPO allotment done?

For oversubscribed IPOs, allotment is done through computerized lottery. For undersubscribed IPOs, all applicants receive full allotment.

Why IPO Ji is the Best Way to Apply for IPOs

While there are multiple ways to apply for IPOs, IPO Ji stands out as the easiest and most comprehensive platform for Indian investors. Here's why:

✅ Fastest Application Process

Apply for any IPO in just 2 minutes with our streamlined interface. No complicated forms or confusing steps.

✅ Complete IPO Information

Get all IPO details in one place: dates, price band, financials, GMP, subscription data, and expert analysis.

✅ Real-Time Subscription Data

Track live subscription numbers updated every hour. Know exactly how many times the IPO is subscribed before you apply.

✅ GMP Updates

Check expected listing premium (GMP) to gauge market sentiment and make informed decisions.

✅ Competition Indicator

Our unique competition indicator shows whether an IPO has low, medium, or high competition, helping you target better allotment opportunities.

✅ Multiple Demat Accounts

Add unlimited Demat accounts and apply for IPOs for yourself, family, and friends—all from one app.

✅ Instant Allotment Check

Check allotment status for all IPOs in one place. No need to visit multiple registrar websites.

✅ Trusted by 25+ Lakh Investors

Join India's largest IPO community with 4.9-star rating and thousands of successful applications daily.

✅ 100% Free

No charges, no fees, no hidden costs. IPO Ji is completely free to use.

Start Applying for IPOs Today!

Now that you know exactly how to apply for IPO online, it's time to take action! Whether you're a beginner or experienced investor, the process is simple and takes just a few minutes.

Quick Recap:

- ✅ Download IPO Ji app for the easiest experience

- ✅ Have your Demat account and UPI ID ready

- ✅ Apply on Day 1 or Day 2 of the IPO

- ✅ Always select cut-off price

- ✅ Check subscription data and GMP before applying

- ✅ Use multiple Demat accounts to increase chances

- ✅ Track allotment status on IPO Ji app

Don't miss the next big IPO opportunity! Download IPO Ji today and join 25+ lakh smart investors who trust us for their IPO investments.

Happy Investing! 🚀