How to Get IPO Allotment in Bharat Coking Coal (BCCL) IPO

The Bharat Coking Coal Limited (BCCL) IPO is shaping up to be one of India's most anticipated PSU offerings of 2026. As a wholly-owned subsidiary of Coal India Limited and the nation's largest coking coal producer commanding 58.5% of India's domestic coking coal output, BCCL represents a rare investment opportunity in India's critical infrastructure sector.

Here's what makes this IPO special: Unlike typical IPOs where you apply and hope for the best, the BCCL IPO comes with a unique shareholder quota advantage that can significantly boost your allotment chances. This is the kind of insider knowledge that separates successful IPO investors from those who just apply randomly.

BCCL IPO At A Glance: Key Details You Need to Know

Before diving into allotment strategies, let's establish the fundamentals.

BCCL IPO Details

Complete Timeline & Structure - RHP Confirmed

| Particulars | Details |

|---|---|

| IPO Price Band PRICE | ₹21 – ₹23 per share |

| Lot Size | 600 shares (approximately ₹13,800 at upper price) |

| Face Value | ₹10 per share FV |

| Total Issue Size ₹1071 Cr | 46.57 crore shares (₹1,071.11 crore) |

| IPO Structure | Offer for Sale (OFS) by Coal India |

| IPO Open Date OPEN | January 9, 2026 |

| IPO Close Date CLOSE | January 13, 2026 |

| Basis of Allotment BoA | January 14, 2026 |

| Listing Date LISTING | January 16, 2026 (BSE & NSE) |

| Book Running Lead Managers | IDBI Capital & ICICI Securities |

Why This Matters: The ₹21-23 price band makes this an accessible IPO for retail investors, while the 600-share lot size (approx ₹13,800) is comfortable for most retail portfolios.

For real-time BCCL IPO details, live GMP tracking, and allotment updates, visit

Understanding BCCL's Investor Reservation Categories

The BCCL IPO is divided into multiple investor categories, each with different allocation percentages and allotment mechanisms. Here's the breakdown:

1. Qualified Institutional Bidders (QIB) – 50%

QIBs include large financial institutions, mutual funds, and insurance companies. This segment gets 50% of the total issue. Allotment for QIBs happens on a proportionate basis, meaning those who bid more get allocated more shares proportionally.

2. Non-Institutional Investors (NII) – 15%

NIIs are typically HNIs (High Net Worth Individuals) divided into two sub-categories:

- Small NII (sNII): Bidding amount between ₹2 lakh to ₹10 lakh

- Big NII (bNII): Bidding amount above ₹10 lakh

For NIIs, allotment generally follows proportionate allocation, giving them better chances than retail in an oversubscribed scenario.

3. Retail Individual Investors (RII) – 35%

This is where most of us come in. 35% of BCCL shares are reserved for retail investors like you and me. However—and this is critical—if the IPO is oversubscribed (which it likely will be), retail allotment is done entirely through lottery, making your chances 1 in 15 or worse.

This is exactly why the shareholder quota becomes a game-changer.

4. Employee Quota – 5%

BCCL employees get a 5% reservation with a ₹1 per share discount.

5. Shareholder Quota (Coal India Shareholders) – 10%

This is the secret weapon that most retail investors ignore. 10% of the IPO is reserved exclusively for people who own even a single share of Coal India Limited.

The Shareholder Quota: Your Hidden Advantage Explained

Here's where BCCL becomes different from typical retail IPOs. Because BCCL is a Coal India subsidiary, existing Coal India shareholders get a dedicated 10% quota of the IPO shares.

Who Is Eligible for the Shareholder Quota?

If you hold even 1 share of Coal India Limited (trading symbol: COALINDIA on NSE) on the record date, you automatically qualify. According to the RHP (Red Herring Prospectus), the record date is January 2, 2026.

This means: Buy Coal India shares on or before January 1, 2026, and you're in.

Key Eligibility Points:

- Minimum Shareholding: 1 share is enough

- Record Date: January 2, 2026

- Purchase Deadline: January 1, 2026 (ensure T+1 settlement happens before record date)

- Demat Account: Shares must be in your demat account in your own name

How Much Can You Apply in the Shareholder Quota?

The shareholder quota allows you to apply for up to ₹2 lakh worth of BCCL shares. At the upper price of ₹23 per share, that's approximately:

Max can apply: 14 lots (8,400 shares) = ₹1,93,200Min can apply: 1 lot (600 shares) = ₹13,800

This is significantly more than the retail limit of 1 lot.

Why Is the Shareholder Quota Superior?

Let me explain the three major advantages:

1. Better Allotment Chances

- Retail allotment: Expected 1 in 20-25 chance (lottery-based)

- Shareholder quota: Less crowded pool, better chances in proportionate allotment

2. Proportionate Allotment MechanismUnlike retail investors who face a lottery system, shareholder quota applications typically receive allotment based on pro-rata (proportionate) allocation. This means if you apply for ₹2 lakh and the quota is 5x oversubscribed, you'd get ₹60,000 worth of shares instead of zero.

If you apply for max bid for ₹1,93,200 and the quota is 14x oversubscribed, you'd get 1 lot of shares instead of zero.

3. Double Application AdvantageHere's the golden rule that IPO JI followers swear by: You can apply in BOTH categories using the same PAN.

- Apply 1 lot in the Retail category (₹13,800)

- Apply for upto ₹2 lakh in the Shareholder quota

Strategic Guide: How to Maximize BCCL Allotment Chances

Now that you understand the structure, here's the actionable strategy to maximize your allotment probability.

Become a Coal India Shareholder (By January 1, 2026)

- Open a demat account (if you don't already have one)

- Link it to your trading account with a broker

- Buy 1 share of Coal India Limited (NSE: COALINDIA)

- Timing is critical: Purchase must be completed by January 1, 2026 to ensure T+1 settlement by the record date (January 2, 2026)

Why Just 1 Share? The shareholder quota allocation is based on your shareholding percentage in Coal India, not the number of shares. So even 1 share qualifies you, and you can apply for the maximum ₹2 lakh in the shareholder quota regardless of whether you hold 1 or 100 shares.

Prepare for Dual Applications

Create a checklist for submission across both categories:

BCCL Application Categories

RII vs Shareholder Quota - RHP Confirmed

| Category | Max Amount | Min Lot Size | Application Type |

|---|---|---|---|

| Retail (RII) BEST ODDS | ₹2 lakh | 600 shares (1 lot) | Single lot only |

| Shareholder Quota CIL HOLDERS | ₹2 lakh | Minimum 600 shares | Up to 14 lots |

Choose Your Application Method

You have two ways to apply for the BCCL IPO:

Option A: IPO JI's Application Portal (Recommended)

The easiest and most convenient way to apply for BCCL IPO is directly through IPO JI's IPO application feature, which streamlines the entire process.

Benefits:

- Single platform for tracking both retail and shareholder quota applications

- Real-time allotment status updates

- Direct links to official IPO pages

- Community support and discussion forums

Access: Visit

IPO JI's BCCL IPO Page to apply directly.

Option B: UPI Method

Pros:

- Faster and more convenient

- Money blocked only when mandate is approved

- Real-time tracking

Process:

- Log into your broker's app (Zerodha, Upstox, HDFC Securities, etc.)

- Navigate to IPO section → Select BCCL IPO

- Choose "Apply Using UPI"

- Enter: Bid quantity, price, and your UPI ID

- Select "Cut-off Price" (₹23)

- Submit the application

- Approve the UPI mandate request on your bank's UPI app

Best Practice for IPO JI Followers: Apply during pre-opening window (typically 1 day before IPO opens) to avoid last-minute rushes and ensure your mandate gets processed smoothly.

Option C: ASBA Method

Pros:

- Money stays in your bank account until allotment

- Provides detailed paper trail

Process:

- Download ASBA form from NSE or BSE website

- Fill it with your demat details, bid quantity, and price

- Submit to a designated bank (Self-Certified Syndicate Bank)

- Money gets blocked in your bank account

Perfect Your Bid Price Strategy

This is non-negotiable: Always select the Cut-off Price (₹23).

Why?

- Cut-off price ensures your application is eligible across all price points

- Lower bids below the final issue price often get rejected

- With a ₹21-23 price band, cut-off maximizes your chances

IPO JI Pro Tip: Check GMP (Grey Market Premium) for educational purposes and market sentiment. GMP is speculative and changes daily, so use it to understand market mood but not as your primary decision-making factor. Your focus should be on allotment chances and fundamentals.

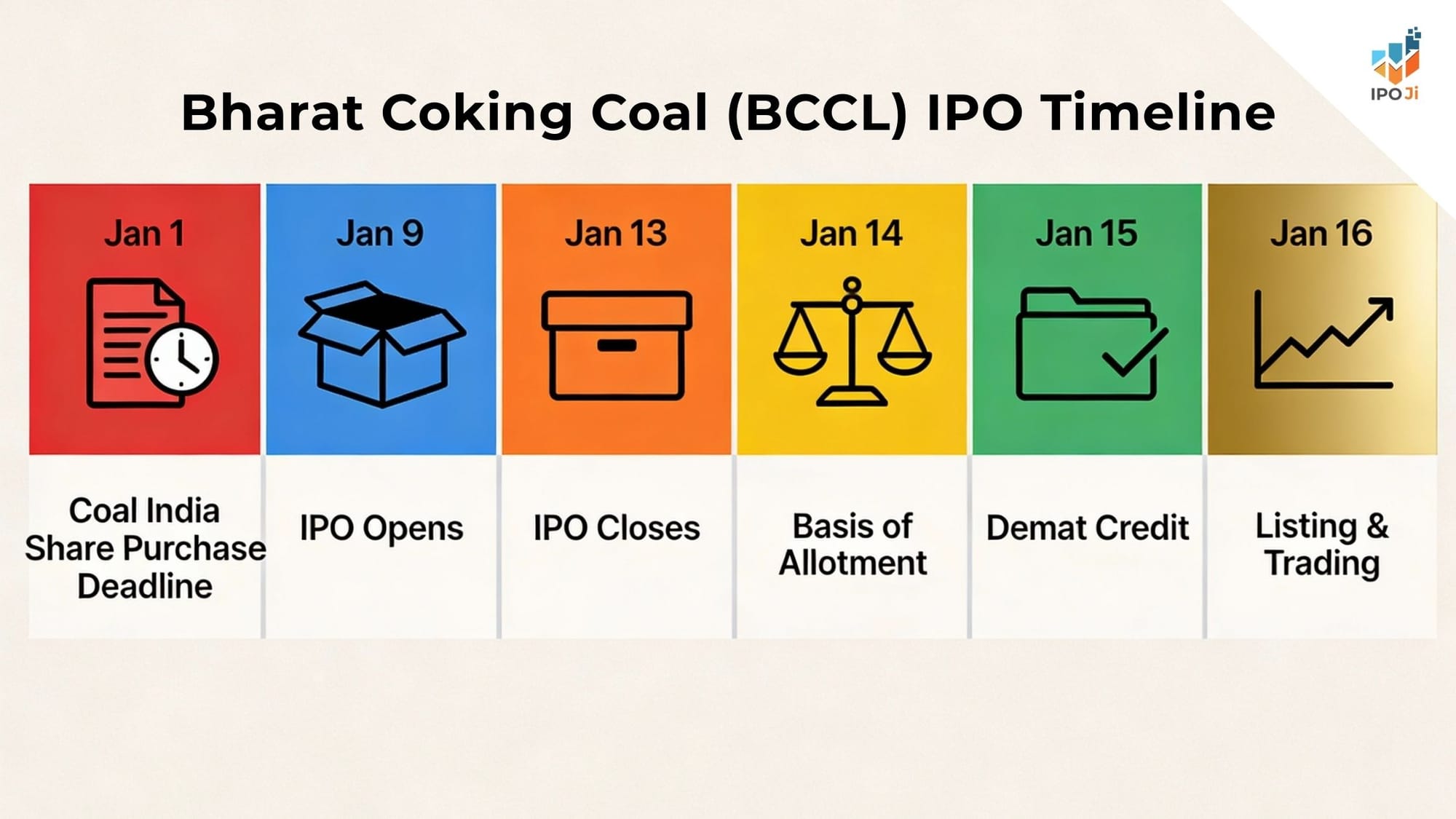

Application Timeline: Don't Miss These Dates

BCCL IPO Timeline

IPO Opens in 3 Days - Jan 9, 2026

| Date | Event | Your Action |

|---|---|---|

| Jan 8, 2026 | Anchor Investor Bidding | Monitor GMP |

| Jan 9, 2026 | IPO Opens for Public | Apply Retail |

| Jan 13, 2026 | IPO Closes (5 PM) | Shareholder Quota |

| Jan 14, 2026 | Basis of Allotment Finalized | Check Status |

| Jan 15, 2026 | Refunds & Demat Credit | Demat Credit |

| Jan 16, 2026 | Listing & Trading Begins | Sell/Hold |

Set Phone Reminders: Don't rely on memory. Set reminders for Jan 1 (Coal India purchase deadline), Jan 9 (IPO opens), and Jan 13 (IPO closes).

Allotment Mechanism: Retail vs. Shareholder Quota

Understanding how allotment actually works is crucial for setting realistic expectations.

Retail Category Allotment (1 Lot Maximum)

Scenario: IPO is oversubscribed 15 times

- Total retail shares available: 35% of 46.57 crore = ~16.3 crore shares

- Total retail applications received: ~16.3 × 15 = ~244.5 crore shares

- Expected retail allotment chances: 1 in 15 (6.67%)

How Allotment Happens:

- Registrar validates all applications

- Since application-wise subscription is >1x (more applicants than available lots), lottery system kicks in

- Computer randomly selects 1 out of every 15 applicants

- Lucky applicants get 1 lot (600 shares)

- Unlucky ones get 0 shares

Your Expected Return: 1 lot or nothing.

Shareholder Quota Allotment (Up to 14 Lots)

Scenario: Same 14x oversubscription

- Total shareholder quota shares available: 10% of 46.57 crore = ~4.65 crore shares

- Estimated shareholder quota applications: ~4.65 × 3-5 times oversubscription (usually less crowded)

- Expected allotment: Proportionate basis

How Allotment Happens:

- Only Coal India shareholders can apply—much smaller pool

- If quota is undersubscribed or moderately oversubscribed, pro-rata allocation kicks in

- If you apply for 10 lots and quota is 2x oversubscribed, you'd get ~5 lots

- Even in worst case (oversubscribed), you're still in a less crowded lottery

This Is Why Dual Application Wins: Even if retail lottery fails, your shareholder quota application has solid chances of partial or full allotment.

How to Check BCCL IPO Allotment Status

Once the basis of allotment is finalized on January 14, here's how to check:

Method 1: IPO JI (Fastest & Most Reliable)

- Visit IPO JI's BCCL IPO Page

- Enter your application number or PAN

- Get instant allotment status with detailed breakup

- Community discussion and real-time updates from other IPO JI followers

This is the quickest and most reliable way to check your allotment status immediately after the basis announcement.

Method 2: Through Your Broker

- Log into your broker's app (Zerodha, HDFC Securities, etc.)

- Navigate to IPO → Check Allotment Status

- Status will show: Allotted (with quantity) or Not Allotted

Method 3: Official Exchanges

NSE Website:

- Go to www.nseindia.com

- Search IPO Allotment Status

- Enter your application number or PAN

BSE Website:

- Go to www.bseindia.com

- IPO section → Allotment Status

- Enter application details

Method 3: Registrar Website

Registrar: KFin Technologies (kfintech.com)

- Direct portal for BCCL IPO allotment checking

- Email for support: bccl.ipo@kfintech.com

IPO JI Tip: Set a reminder for January 14, 2026, 4 PM. Most brokers update allotment status within hours of official announcement.

Disclaimer

This blog is for educational and informational purposes only. It does not constitute investment advice. Please consult a SEBI-registered investment advisor before making investment decisions. Past performance of stocks and IPOs is not indicative of future results. Individuals must conduct their own research and understand their risk appetite before investing in IPOs.

For real-time BCCL IPO updates and allotment discussions, follow IPO JI's latest content across Instagram, and Twitter.