India's IPO Market in 2025: A Record-Breaking Year

2025 will be remembered as India's most extraordinary IPO year in history. Companies across the country raised a landmark ₹1.95 lakh crore through 365+ IPOs—surpassing the previous 2024 record of ₹1.90 lakh crore and marking a historic inflection point for India's capital markets. When combined with 2024's performance, the past two years alone saw ₹3.8 lakh crore mobilized through 701 IPOs—nearly equivalent to the entire five-year period from 2019–2023. For retail and institutional investors, 2025 delivered exceptional opportunities: mega-issuances from Tata Capital (₹15,511 crore), record-breaking retail applications (60+ lakh per IPO), and listing-day gains ranging from 50% to 65%.

As we head into 2026 with ₹2.55 lakh crore lined up in IPO pipelines (including Reliance Jio, PhonePe, Flipkart, and NSE), this is your complete playbook to understand 2025's IPO revolution and prepare for what's coming next.

The 2025 IPO Boom — Why 2025 Was Historic 📊

The Numbers Tell an Incredible Story

Let's start with what makes 2025 so special:

- ₹1.95 lakh crore raised through 365+ IPOs—the single biggest year in Indian IPO history

- This crushed 2024's record of ₹1.90 lakh crore (and that was already a blockbuster year)

- Combined 2024–2025: ₹3.8 lakh crore through 701 IPOs—nearly matching the entire five-year total (2019–2023) of ₹3.2 lakh crore

- This is a 12-fold jump compared to fundraising levels from just a decade ago

Translation: India's capital markets grew more in two years (2024–2025) than in the previous five years combined. This isn't normal market growth—this is a structural shift.

Why Did 2025 Break Records? Four Big Reasons

1. Financial Services (NBFC) Boom — 26.6% of All IPO Capital

India's lending market exploded. NBFC IPOs led the 2025 parade because:

- Rising consumer credit demand (cars, home loans, personal loans)

- Retail investors hungry for lending-backed securities

- Government encouraging NBFCs as alternatives to traditional banks

- Companies like Tata Capital (₹15,512 crore) and HDB Financial (₹12,500 crore) tapped this wave

Translation: If you borrowed money in 2025—for a car, home, or personal loan—you likely borrowed from a company that went public that year.

2. Technology, Healthcare, Consumer Durables — Broad Sector Participation

Unlike 2020–2023 (when IPOs were concentrated in fintech), 2025 saw diversified sectors:

- Infrastructure companies capitalizing on government's Bharatmala and Smart Cities projects

- Home services (Urban Company) digitizing India's fragmented cleaning/plumbing/repair sector

- Surveillance tech (Aditya Infotech/CP Plus) riding India's AI and smart city adoption

- Consumer electronics (LG Electronics India) leveraging India's durable goods boom

This breadth is healthy. It means the IPO market isn't a bubble in one sector—it's genuine capital needs across the economy.

3. Retail Investor FOMO Hitting Peak Levels

India's demat account base grew 3–4x since 2020. These new investors wanted in on IPOs:

- LG Electronics: 65+ lakh retail applications (imagine a line of 6.5 million people trying to buy shares)

- Meesho: 62.75 lakh applications

- ICICI Prudential AMC: 55.07 lakh applications

When 65 lakh people apply for an IPO offering only 30–50 lakh shares total, scarcity creates value. Retail allocations averaged just 1–2% of applications requested. This FOMO drove listing-day premiums as high as 64%.

4. PE/VC Exit Windows Opening

Global investors like Meta (Facebook), Google, Walmart, SoftBank, and Tiger Global invested $50+ billion into Indian startups over 2015–2022. Many had held for 8–10+ years and needed exits. IPO windows provided structured liquidity. Think of 2025–2026 as the "harvest season" for early venture investors.

The Biggest IPOs — Meet the Titans 👑

1. Tata Capital (₹15,512 Crore) — The Record Breaker

What is it?Tata Group's NBFC subsidiary providing auto loans, home loans, personal loans, and other financing.

Why it matters:

- India's largest IPO at the time (just narrowly beaten by later mega-deals)

- Part fresh capital (₹6,846 crore) to grow lending, part stake sale by Tata Sons

- Signals that even mature, profitable lending businesses can command massive IPO sizes

Post-listing performance:Down slightly (-0.21%), but stable—showing the market valued it fairly.

Investor takeaway: Not all IPOs deliver listing gains. Tata Capital's stable performance reflects fair pricing; investors get steady growth, not lottery-style gains.

2. HDB Financial Services (₹12,500 Crore) — HDFC Bank's Lending Arm

What is it?HDFC Bank's 94%-owned NBFC subsidiary, providing vehicle finance, commercial loans, and personal credit.

Why it matters:

- HDFC Bank partial exit from its subsidiary while injecting growth capital

- Shows how parent companies unlock subsidiary value via IPO

- Attracted strong institutional (QIB) interest

Post-listing performance:Up +2.59%—modest but positive.

Investor takeaway: Parent-backed NBFCs have structural advantages: brand credibility, funding access, operational know-how. This translated to stable post-IPO performance.

3. LG Electronics India (₹11,607 Crore) — The Record-Breaking Retail Favorite

What is it?South Korea's LG Electronics' Indian consumer electronics subsidiary (TVs, refrigerators, ACs, washing machines, microwaves).

Why it broke records:

- 65+ lakh retail applications—most any company received in 2025

- QIB subscription hit ₹3.84 lakh crore—a mind-bending institutional demand signal

- Strong brand loved by Indians for 3 decades

- Entire IPO was offer-for-sale (LG Inc. exiting India through this offering)

Post-listing performance:Up +36.4%—stellar returns.

Why it soared:

- Consumer electronics demand booming as India's middle class buys appliances

- Brand equity unmatched in organized retail electronics

- Limited shares available (scarcity = premium)

Investor lesson: When 65 lakh people want to buy and only 30 lakh can, the stock opens premium. LG rewarded patient investors with strong long-term gains too, as the business fundamentals supported higher valuations.

4. Hexaware Technologies (₹8,750 Crore) — IT Services Play

What is it?IT services company providing software development, BPO, and digital transformation services to global clients.

Post-listing performance:+6.79% gains.

Why it mattered:India's IT services sector continues exporting tech talent globally. Hexaware's IPO tapped into demand for this structural trend.

5. Lenskart Solutions (₹7,278 Crore) — Omnichannel Retail

What is it?India's largest eyewear retailer blending e-commerce and physical stores.

Why significant:Represents India's organized retail growth in niche categories. Lenskart was nearly profitable, with strong growth—textbook IPO profile.

Highest QIB subscription in 2025

The Blockbuster Winners — IPOs That Delivered 50%+ Gains 🚀

Not all IPOs are equal. Some delivered extraordinary returns on day one. Here's who won big:

🏆 Highway Infrastructure Limited — +64% Gain

What:Infrastructure company operating toll collection systems, electronic toll booths (for Fastag), and road maintenance contracts.

The Listing Day:

- Issue price: ₹70 per share

- Opening price: ₹115 per share

- Return: +64.29%

Why it soared:

- Government order visibility: 92% of revenue from public sector projects (Bharatmala, highway projects)

- Predictable cash flows: Toll collections are recurring, steady revenue

- Order book: ₹666+ crore in secured contracts

- Scarcity value: Limited shares relative to demand

Investor lesson: Infrastructure plays with government backing and recurring revenue model can deliver strong listing premiums. The key: order book visibility reduces risk.

🏆 Urban Company — +57.5% Gain

What:Technology marketplace for home services (plumbing, electrical, cleaning, painting, carpentry). Think of it as "Uber for home maintenance."

The Listing Day:

- Issue price: ₹103

- Opening price: ₹162.25

- Return: +57.5%

The backstory:

- Turned profitable in FY25 (₹239.77 crore profit vs. ₹92.77 crore loss prior year)

- 103x oversubscription—investors desperate to own it

- Retail allocation: Only 1-2% of those who applied received shares

Why it kept soaring:

- Post-listing: Extended gains to 70%+ before correcting in later months

- Market size: ₹59.2 billion home services market, mostly unorganized (opportunity!)

- International expansion: Operating in UAE, Singapore, Saudi Arabia

🏆 Aditya Infotech (CP Plus) — +50.8% Gain

What:Video surveillance technology and CP Plus branded cameras. Think: security cameras for homes, shops, and businesses—a "boring" business that's actually booming due to AI and smart cities.

The Listing Day:

- Issue price: ₹675

- Opening price: ₹1,018

- Return: +50.4% (highest of 2025 at the time)

Why it was a winner:

- Explosive profit growth: 205% YoY profit surge in recent financials

- Market presence: Operating in 550+ Indian cities

- Structural tailwind: Government's AI Surveillance Initiative, Smart Cities project, rising home security awareness

- Strong margins: EBITDA margin of 16.29%, ROE of 34.53%

Investor takeaway: Sometimes highest listing gains come with stretched valuations. Great growth doesn't always mean great investment returns if you pay too much.

🏆 LG Electronics — +50% Gain

As covered earlier, strong fundamentals, brand equity, and consumer discretionary tailwinds drove solid returns.

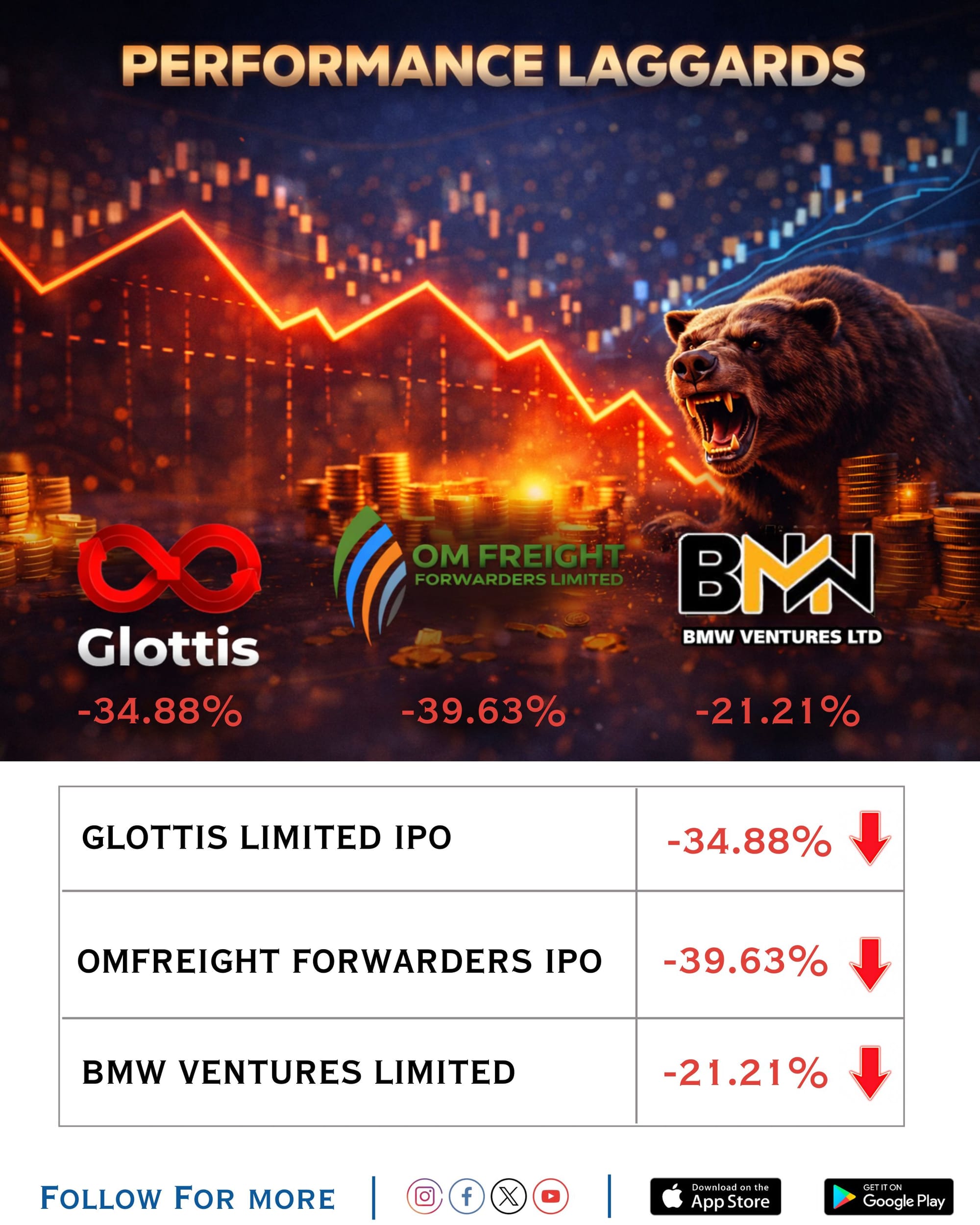

The Underperformers — Not All IPOs Won ⚠️

Here's the uncomfortable truth: Not every 2025 IPO was a winner. Three notable laggards emerged:

📉 Glottis Limited — -34.88% Loss

Issue price → Listing Price: Down nearly 35%

What went wrong?

- Narrow competitive moat in services sector

- Execution challenges post-listing

- Market reassessment of business model

📉 OMFreight Forwarders — -39.63% Loss

Issue price → Listing Price: Down nearly 40%

What went wrong?

- Logistics sector headwinds

- Possible customer concentration risks

- Valuation mismatch at listing

📉 BMW Ventures Limited — -21.21% Loss

Issue price → Listing Price: Down nearly 21%

What went wrong?

- Automotive sector slowdown impacting ventures business

- Venture returns are unpredictable and long-gestation

The 2026 IPO Watchlist — What's Coming Next

If 2025 was record-breaking, 2026 might be even bigger. Here's what's lined up:

📱 Reliance Jio — The Potential "Largest IPO Ever"

Timing: First half of 2026 (confirmed by Mukesh Ambani himself at Reliance AGM in August 2025)

Size:

- Potential IPO size: ₹52,200 crore (~$6 billion)

- This would represent a 5% stake in Jio

- Valuation: ~₹112 billion USD (or $170+ billion depending on deal structure)

Context:

- Would be India's largest IPO ever—dwarfing Hyundai Motor India (₹28,000 crore in 2024)

- Likely one of the world's largest IPOs for 2026

Why it's happening:

- Jio has 500+ million subscribers, dominates Indian telecom with 42.3% revenue market share

- Represents value unlock for early investors: Meta (Facebook) and Google invested $20+ billion in Jio Platforms

- Signals India's position in global tech/telecom: homegrown platforms can create $100+ billion value

For retail investors:

- MASSIVE institutional demand expected

- Very limited retail allocations (likely <10% of applications honored)

- Must apply through proper broker channels; competition will be fierce

For portfolio investors:

- Jio's IPO will likely dominate market activity in H1 2026

- Secondary market will be crucial—buying post-listing might be smarter than fighting for IPO allocation

💳 PhonePe — India's Payments Champion

Timing: Mid-2026 (confidential filing made with SEBI in September 2025)

Size:

- IPO size: ₹11,000–13,000 crore (~$1.3–1.5 billion)

- Valuation target: $12–15 billion

Why it matters:

- India's #1 UPI payments app with 48%+ of transaction market share

- 600+ million registered users

- Recently turned profitable; losses narrowing dramatically (₹17.2 billion in FY25, down from ₹19 billion)

- Represents fintech's maturation in India

Ownership:

- Walmart (60%+), Microsoft, Tiger Global, others expected to dilute stakes via offer-for-sale

- Major exit event for early VC investors

For investors:

- Strong product-market fit and unit economics make this compelling

- First major UPI platform IPO—historical significance

- Watch Q3/Q4 FY26 updates on profitability trajectory before listing

📊 NSE (National Stock Exchange) — India's Primary Bourse

Timing: 2026 (exact timeline uncertain; governance approvals largely complete)

Significance:

- Exchange listing itself would be monumental—reflects India's capital markets maturity

- Infrastructure play on India's equity market growth

- Limited competitor (only BSE is other main exchange, and smaller)

Investor angle:

- Plays on India's equity market expansion at the infrastructure level

- Similar to NYSE/Nasdaq positioning in US

🛒 Flipkart — E-Commerce Giant

Timing: End of 2026 (NCLT approval for Singapore-to-India domicile shift received December 2025)

Size:

- Current valuation: ~₹35–36 billion

- Expected IPO size: ₹10,000+ crore (exact TBD)

Ownership:

- Walmart (77%), Microsoft, Google, CPPIB, SoftBank, Tencent

Why it matters:

- 500+ million registered users

- Subsidiaries: Myntra (fashion), Ekart (logistics)

- Walmart's India ambitions vehicle; positions to eventually challenge Amazon India

Challenges:

- Tencent (5–6% stake) from China requires government Press Note 3 approval

- Administrative hurdles, but routine and likely to be cleared

For investors:

- Represents Indian e-commerce consolidation play

- Secondary market opportunities likely stronger than IPO allocation chances

🏨 OYO Rooms — Hospitality & Travel

Timing: 2026 (TBD)

Business:

- Global hospitality platform spanning 80+ countries

- 1.5+ million rooms on platform

- Asset-light franchise model

Opportunity:

- Post-COVID travel recovery

- Global expansion story

📦 Zepto — Quick Commerce Leader

Timing: H2 2026 (estimated, not officially confirmed)

Business:

- Quick-commerce (10–15 minute grocery delivery)

- Valued >$5 billion (unicorn status)

- Competes with Blinkit (Zomato-backed)

Market opportunity:

- Q-commerce growing 30%+ annually

- Zepto's market leadership and unit economics compelling if profitable

💼 Other Tier-2 IPOs Lined Up

- SBI Mutual Fund: Benefits from India's mutual fund AUM boom

- boAt: Consumer electronics; strong D2C brand among youth

- Hero FinCorp: NBFC capturing auto finance growth

The 2026 IPO Pipeline: By The Numbers 📈

SEBI-Approved Companies Ready to List:

- 84+ companies approved to raise ₹1.14 lakh crore

- 100+ additional companies awaiting approval for ₹1.4 lakh crore

- Total 2026 IPO pipeline: ₹2.55 lakh crore+

Comparison:

- 2025: ₹1.95 lakh crore

- 2026 expected: ₹2.55+ lakh crore

- 2026 could be 30% bigger than record-breaking 2025

How to Invest in IPOs

Before You Apply: The Checklist

Ask these 8 questions about ANY IPO:

1. Revenue Growing? (Target: 25%+ YoY minimum)

- Check the prospectus financials

- Is revenue accelerating or decelerating?

- For B2B companies, check order books (indicates future revenue)

2. Profitability Improving? (Target: EBITDA positive or profit inflection visible)

- Don't chase companies perpetually losing money

- Look for signs of profit inflection (losses narrowing, path to profitability clear)

- Post-COVID scams showed "losses forever" is not acceptable

3. Valuation Reasonable? (Target: P/S <10x for SaaS; P/E <30x for established businesses)

- Compare IPO valuation to peers

- Is company asking premium or discount vs. competitors?

- Aditya Infotech at 52x earnings = stretched (but still worked due to scarcity)

4. Market Leadership? (Target: #1 or #2 in segment, >20% market share)

- Is company a category leader?

- Or #3-5 in crowded space?

- Leaders command premiums; laggards get discounts

5. Recurring Revenue? (For B2B: 50%+ recurring is ideal)

- Subscriptions = predictable

- One-off projects = unpredictable

- Toll collections (Highway Infra) = 100% recurring

6. Management Execution Record? (Track record matters)

- Have founders/management successfully exited before?

- Any governance issues, promoter wrongdoing?

- Red flags: Complex related-party transactions, frequent CEO changes

7. Customer Concentration Risk? (Target: Top 5 customers <40% revenue)

- If 3 customers represent 60% of revenue, that's risky

- Any customer loss = massive impact

8. Sector Headwinds? (Is the industry growing or shrinking?)

- Growing sectors: Home services, Q-commerce, fintech, infra, surveillance

- Shrinking: Print media, telecom (stable), legacy retail

- Sector trends matter as much as company fundamentals

The Critical "What If I Miss Out?" Conversation

FOMO is IPO investors' biggest enemy. Here's the truth:

- 65 lakh people applied for LG Electronics. Only 30 lakh got shares (45% success rate).

- If you didn't get allotted? You're not alone. 70% of applicants didn't.

- Secondary market opportunity: The stock opened at ₹1,555. You can buy it there. Yes, you missed the 36% gain from ₹1,140→₹1,555. But you can still own LG Electronics shares.

Not getting an IPO allotment isn't a disaster. It's normal. The secondary market provides ample opportunity to own quality companies. Sometimes buying post-listing at a cooler price is smarter than fighting 65 lakh other investors for 30 lakh shares.

2026 Is Going to Be Massive 🚀

2025 broke all IPO records. 2026 could break them again.

With Reliance Jio ($170 billion company), PhonePe ($15 billion company), Flipkart ($35 billion company), NSE, OYO, Zepto, and 80+ others in the pipeline, 2026's IPO market will be absolutely historic.

The opportunity:

- 2026's IPO pipeline (₹2.55+ lakh crore) will create millionaires and punish the careless

- The difference between 50% gains and 30% losses = homework and discipline

Your next steps:

- Download the IPO prospectus for any IPO you're considering

- Run it through the 8-question checklist (revenue growth, profitability, valuation, leadership, etc.)

- Decide your bucket: Listing-gain trade, long-term hold, or secondary market buy

- Position size correctly: Max 2–3% per IPO

- Apply with a plan: Know your exit before you invest

IPO Ji's Role: Your IPO Command Center

As you navigate 2025's record and 2026's opportunities, IPO Ji is your single platform to:

✅ Track all SEBI-approved IPOs and upcoming pipelines

✅ Access detailed prospectuses and financial analysis

✅ Compare valuations across peer companies

✅ Set alerts for IPO opening/closing dates

✅ Join community insights from 500k+ Indian IPO investors

✅ Get expert deep-dives on each major IPO

Whether you're a seasoned trader or first-time IPO investor, IPO Ji helps you avoid costly mistakes and capitalize on genuine opportunities.

The 2026 Countdown Begins 🎊

2025 was historic. 2026 will be legendary.

Are you ready to be part of India's IPO revolution?

Your move. Your decision. Your wealth creation journey starts here.