IPO Process

Step-by-Step Guide to the IPO Process

1. Merchant Banker (Lead Manager) Appointment

An IPO process requires a Merchant Banker (Lead Manager) appointment as the starting point to assist the company through preparation for release. A merchant banker must perform several responsibilities which include:

The process involves examining both financial information and legal position of the company at hand.

One of the main tasks of the company at this point involves the creation of the Draft Red Herring Prospectus (DRHP).

The company works in tandem with SEBI and stock exchanges together with other regulatory bodies.

A Lead Manager conducts complete IPO release orchestration from start to finish until post-listing activities are complete.

The extensive offering size of Zomato and Nykaa led them to appoint numerous merchant bankers for their IPO process.

2. DRHP Submission and SEBI Approval

Financial and legal management entities submit Draft Red Herring Prospectus files (DRHP) to SEBI for assessment.

The company passes SEBI evaluation before receiving final approval through financial inspection and risk assessment and compliance checks.

SEBI requires 2 to 4 months for review of the document.

3. IPO Application to Stock Exchanges

The company files its IPO application to NSE and BSE stock exchanges only after receiving DRHP approval from SEBI.

Exchanges check the stated information and grant essential approval.

4. The method for determining prices rests between using fixed pricing or the book building approach.

The organization together with its lead managers selects what method will be used to determine the pricing terms.

The IPO price issue starts with a predetermined value that stock exchanges disclose to the public.

For the Book Building Issue, the organizational team establishes minimum and maximum bidding levels (e.g., ₹500-550) and allows investors to submit their offers. Financial corporations determine the final IPO value through evaluating investor interest.

Tata Technologies determined its IPO issue price to be ₹500 by establishing a price band from ₹475 to ₹500.

5. Red Herring Prospectus (RHP) Submission

The RHP communicates updated financial statements together with IPO timing information after refining the original DRHP.

SEBI, together with stock exchanges, receives the document prior to the start of the IPO.

6. IPO Roadshow and Marketing

During its IPO marketing phase, the company uses roadshows to have merchant bankers and executives, and financial analysts approach institutional investors, along with retail investors.

Marketing includes TV ads, social media campaigns, and investor meetings to generate interest.

7. IPO Open for Anchor Investors

Large institutional investors known as Anchor Investors participate in share purchases for IPOs one day prior to the public opening.

Big investors put at least ₹10 crore capital in the IPO which creates strong market confidence for the public offering.

8. IPO Open for Public Subscription

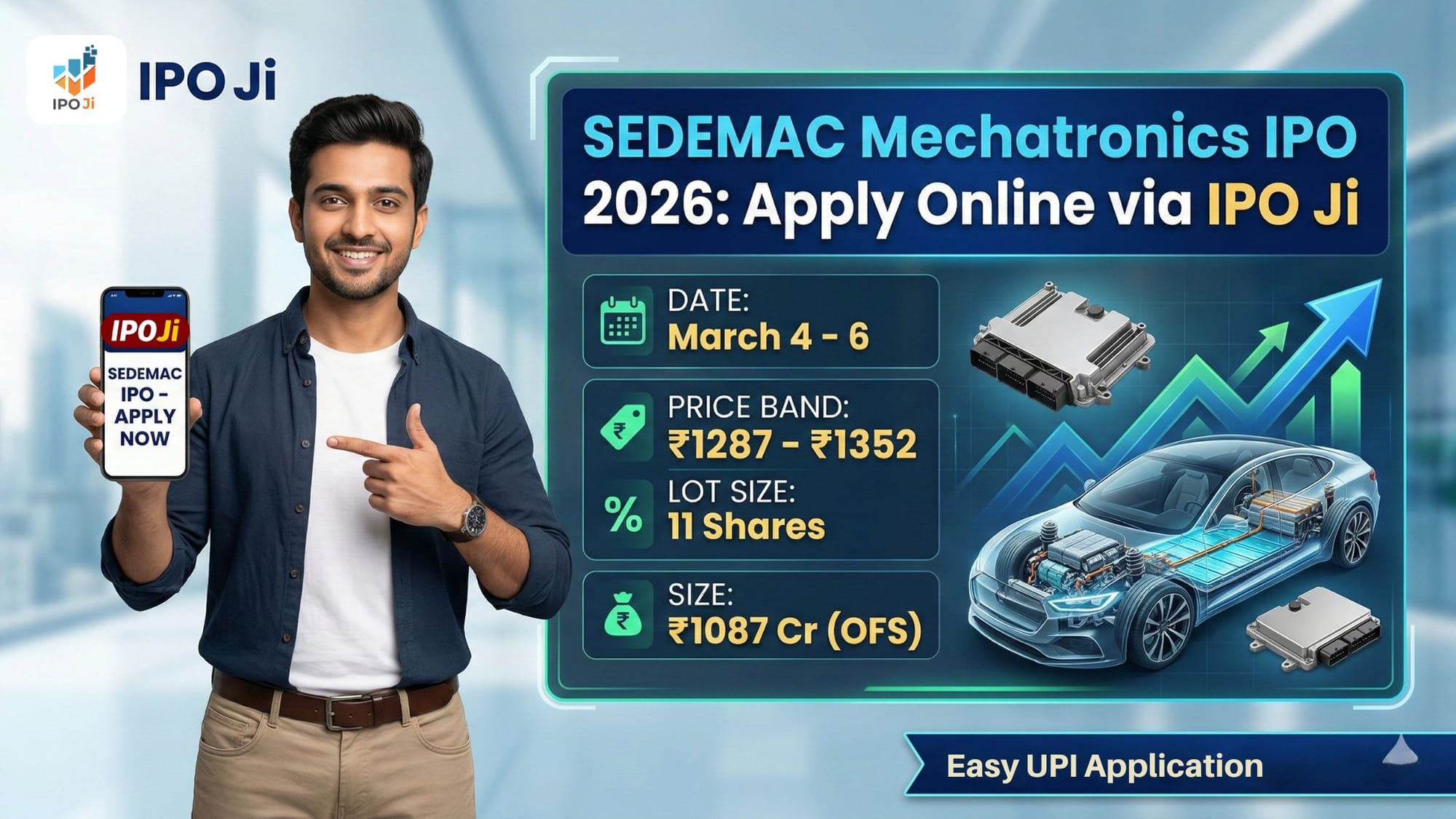

The retail investors and qualified High Net Worth Investors, along with institutional investors, can participate in the IPO subscription period of 3 to 10 days.

The allocation process starts with utilizing UPI systems or ASBA (Application Supported by Blocked Amount) and net banking functions.

Because of overwhelming public interest, there will be more oversubscription, which will raise the chances of receiving shares from the lottery selection process.

9. IPO Shares Allotment

The registrar validates all applicants through a process which either selects shares randomly or distributes them proportionally after the trading period ends.

Payments for shares that remain unallotted start the immediate process of refund.

A success during the IPO process results in share distribution to the winning applicant's Demat account.

10. IPO Listing Date Announcement

The firm presents its ultimate listing documentation to both stock exchanges.

The date when the trading begins is declared through a formal announcement to the general public.

11. IPO Listing on Stock Exchange

The released IPO shares commence full trading activities at NSE/BSE.

The opening session from 9:00 AM and 9:45 AM evaluates the price through market demand.

Regular trading starts at 10:00 AM.

Market demand determines the stock price during its first day of trading which may result in either listing gains or losses.

During the FirstCry IPO investors experienced significant surprise as the listed shares rose to 40% above the original issue price.

12. Post-Listing Compliance and Disclosures

The issuing firm needs to deliver audit reports together with shareholding pattern information as well as corporate governance documentation to the authorities.

The company needs to uphold SEBI and stock exchange regulations throughout all phases following the completion of its IPO.

Mainboard vs. SME IPO: Key Differences

IPO Process Timeline in India

IPO Process Timelines by IPO Platform (Tentative)

IPO Process Timelines by Stages (Tentative)

👉 Total time: 3 months to 1 year, depending on complexity.

FAQs About the IPO Process

1. What is an IPO?

An IPO represents the first time a private company offers its stocks to public ownership to acquire capital.

2. How can retail investors apply for an IPO?

Retail investors apply for IPOs through UPI as well as ASBA which supports net banking and authorized trading platforms including Zerodha, Groww, and AngelOne.

3. What is the lowest amount that investors must contribute during an IPO?

The minimum investment in an IPO depends on the specified lot size where each lot represents thirty shares therefore an investment of fifteen thousand rupees is required when a share costs five hundred rupees.

4. What does the process become when an IPO receives more subscriptions than available shares?

The shares go to retail investors through a lottery system, while institutional investors get their shares proportionate to their original request.

5. Can I execute the sale of my Initial Public Offering shares on the day of its first public listing?

IPO investors can choose to sell their issued shares when the market lists them on the initial day ultimately gaining or losing funds.

6. Through which process can I determine my IPO allotment status?

The websites of Link Intime and KFinTech act as broker platforms for investors to monitor their IPO allotment status.