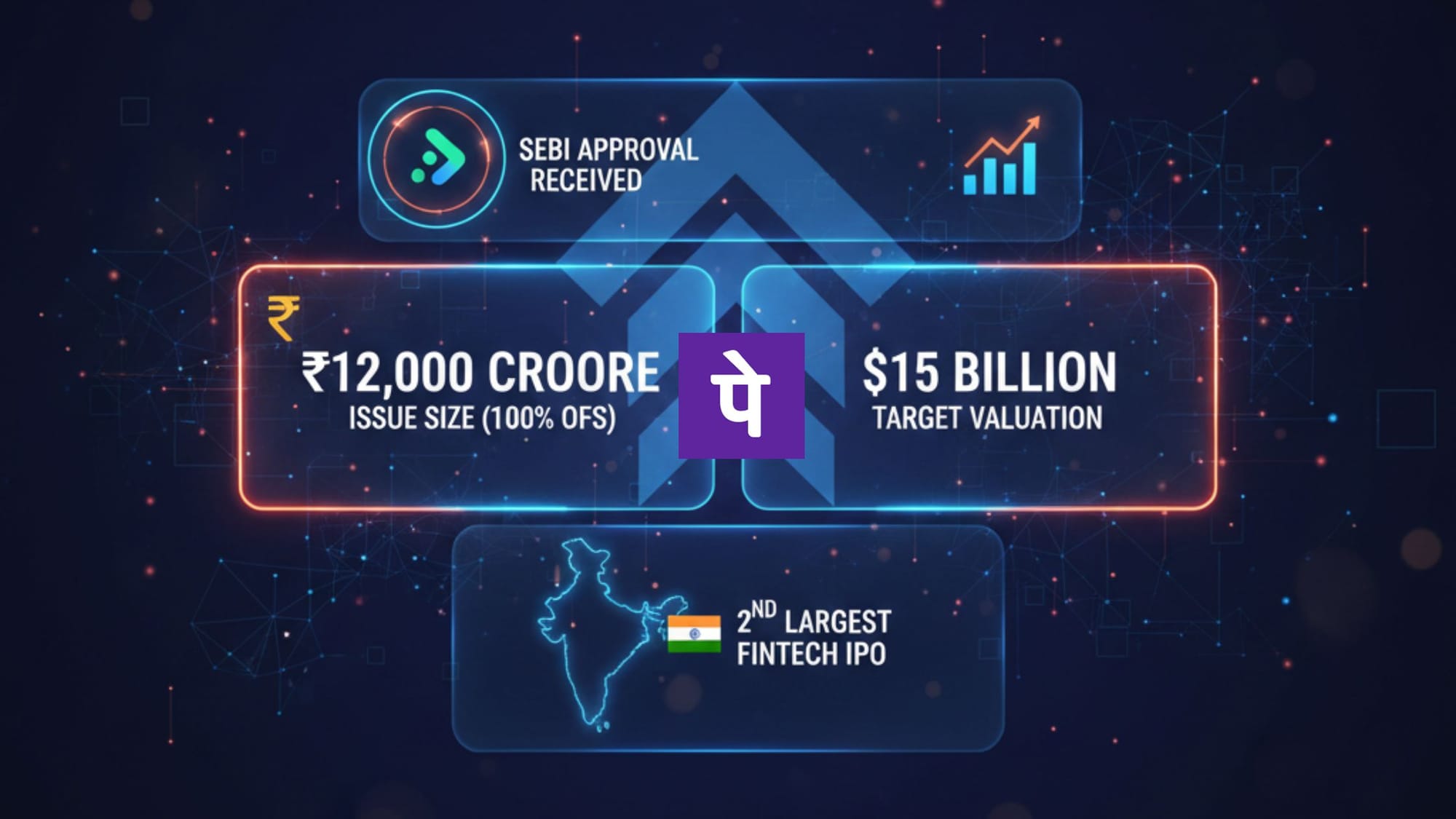

PhonePe IPO Alert! SEBI Green Signal for India’s ₹12,000 Cr Fintech Giant

The wait is finally over for India’s biggest fintech listing of 2026! PhonePe has received SEBI approval for its much-awaited Initial Public Offering (IPO). This milestone marks the second-largest "New Economy" listing in Indian history, trailing only behind Paytm’s 2021 debut.

Whether you are a seasoned investor or an IPO beginner using the IPO Ji app, this is a "Mainboard" listing you cannot afford to miss.

PhonePe IPO: Key Details at a Glance

According to the latest filings and reports as of January 21, 2026, here is the quick snapshot of the offering:

| Feature | Details |

|---|---|

| Expected Issue Size | Approx. ₹12,000 Crore ($1.35 Billion) |

| Listing Valuation | Targeted at ₹1,37,600 Cr |

| IPO Type | Pure Offer for Sale (OFS) |

| Major Sellers | Walmart, Tiger Global, and Microsoft |

| Market Share | 45% of India's UPI transactions |

PhonePe Limited has filed U-DRHP with Securities and Exchange Board of India, moving a step closer to becoming India’s second-largest fintech listing 📈

Key IPO Details:

- Issue Type: 50,660,446 shares (OFS)

- Retail Portion: 10%

- Face Value: ₹1

- Expected Issue Size: ~₹12,000 Cr

- Listing Target: Mar–Apr 2026

A major milestone for India’s fintech ecosystem!

Why is the PhonePe IPO a Big Deal?

PhonePe isn't just a "payment app" anymore; it’s a financial powerhouse. If you are tracking this on IPO Ji, here are the fundamentals driving the buzz:

- UPI Dominance: With 10 billion monthly transactions, PhonePe is the undisputed king of UPI, holding a 10% lead over its closest rival, Google Pay.

- Path to Profitability: Unlike many startups, PhonePe reported a massive jump in its FY25 financials. Revenue hit ₹7,115 crore (up 40%), and it turned Free Cash Flow positive with ₹1,202 crore.

- The Ecosystem Play: From the Indus Appstore to Share.market (stock broking) and insurance, the company has diversified its revenue beyond just merchant payments.

Investor Note: Since this is a pure Offer for Sale (OFS), the money raised goes to the selling shareholders (like Walmart and Microsoft), not into the company’s treasury. This is often seen as a liquidity event for early backers.

Comparison: PhonePe vs. Fintech Titans (in ₹ Crore)

Understanding how PhonePe’s valuation compares to its listed peers is essential for predicting its potential Grey Market Premium (GMP) and long-term listing gains.

| Company | Status | IPO/Listing Valuation | Current Market Cap (Jan 2026) |

|---|---|---|---|

| PhonePe | Upcoming | ₹1,37,600 Cr ($15B) | — |

| Paytm | Listed | ₹1,83,400 Cr ($20B) | ₹85,150 Cr ($9.3B approx.) |

| Groww | Listed | ₹68,800 Cr ($7.5B) | ₹96,300 Cr ($10.5B) |

| PB Fintech | Listed | ₹55,000 Cr ($6B) | ₹82,550 Cr ($9B) |

How to Apply & Track via IPO Ji

Stay ahead of the crowd by using the IPO Ji app to monitor the live subscription status.

- Check Allotment Status: Use the integrated links for KFintech or Link Intime directly in the app.

- Live Subscription: Watch the QIB, NII, and Retail quotas in real-time.

- Expert Reviews: Read in-depth analysis on whether the $15 billion valuation leaves "money on the table" for retail investors.

📅 What’s Next?

PhonePe is expected to file its Updated DRHP (UDRHP) within the next few days. The actual listing is likely to happen by April 2026. Keep your Demat accounts ready!