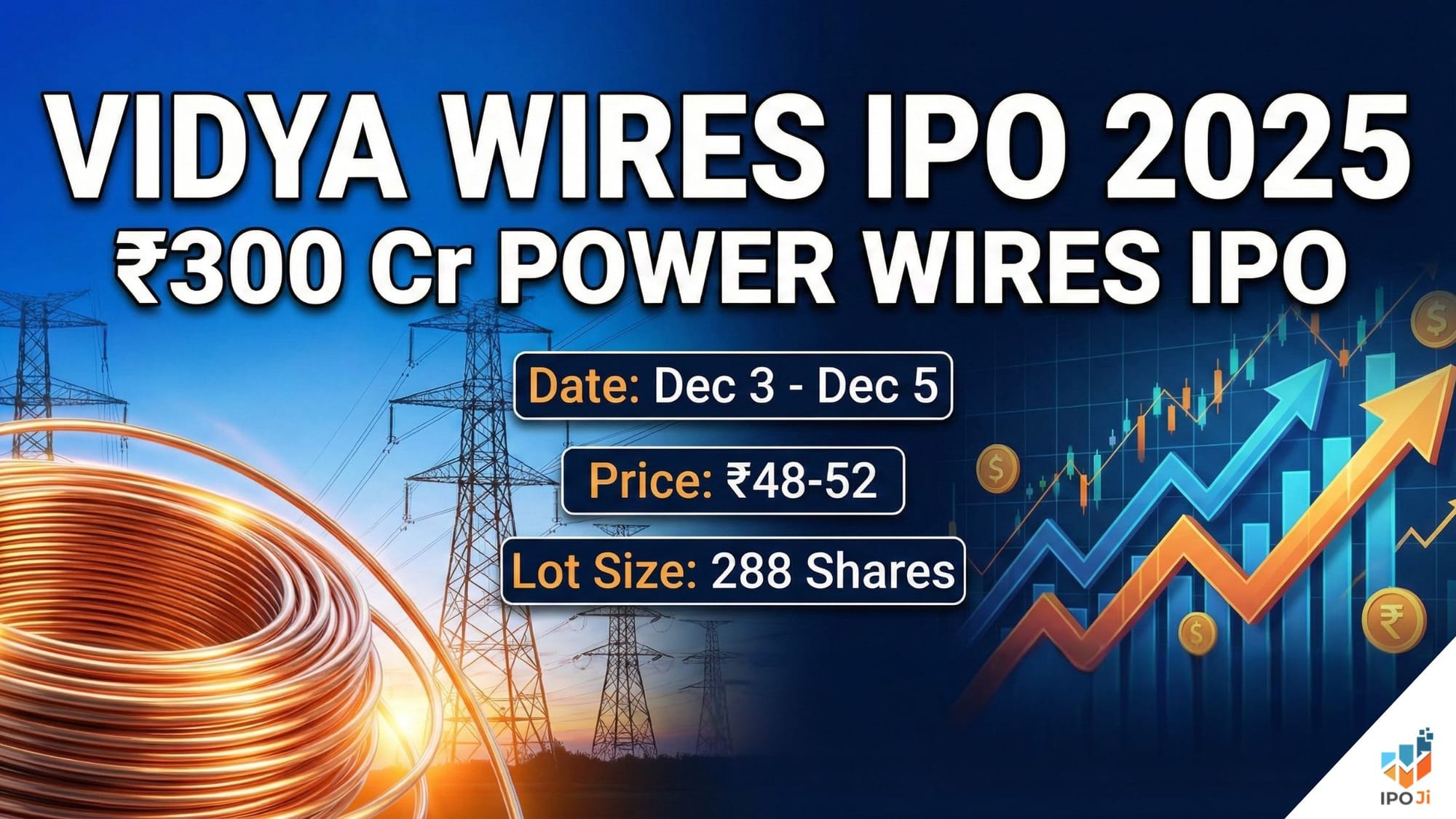

Vidya Wires IPO 2025: Complete Guide to ₹300 Cr Power Wires IPO | Date, Price ₹48-52, Lot Size 288, GMP, Apply via IPO Ji

Vidya Wires is launching its ₹300.01 crore IPO, which includes a fresh issue of ₹274 crore and an ₹26.01 crore offer for sale. The IPO opens on December 3, 2025, and closes on December 5, 2025. Allotment is expected on December 8, with a tentative listing on December 10 on both BSE & NSE.

Vidya Wires Limited, a leading manufacturer of winding and conductivity products for power transmission, electric vehicles, and renewable energy, opens its ₹300.01 crore IPO on December 3, 2025. Fixed price band stands at ₹48-₹52 per share with a lot size of 288 shares (minimum retail investment ₹14,976 at upper band). The issue comprises ₹274 crore fresh issue and ₹26.01 crore offer for sale (OFS), listing on BSE and NSE on December 10, 2025.

Track everything on IPO Ji: Vidya Wires IPO Page

for live GMP, subscription status, allotment checker, and one-click broker application links.

Vidya Wires IPO Key Dates & Timeline

Pro Tip: Bookmark IPO Ji Vidya Wires Tracker for real-time updates.

Vidya Wires IPO Issue Details

Investor Allocation: 50% QIB, 15% NII, 35% Retail (favorable for individual investors).

Vidya Wires IPO Lot Size & Investment Guide

Investors apply in multiples of 288 shares.

How to Apply for Vidya Wires IPO via IPO Ji ?

Applying for IPOs is now seamless with the IPO Ji App. Follow these steps:

- Download & Register on IPO Ji App.

- Go to the Vidya Wires IPO Page.

- Select your Investor Category (Retail / HNI / QIB).

- Enter UPI ID, Lot Size, and Price.

- Confirm UPI mandate on your banking app.

- Track allotment status and listing updates directly on IPO Ji.

About Vidya Wires Limited

Established in 1981 at GIDC, Anand, Gujarat, Vidya Wires manufactures precision winding wires and conductivity products for critical applications:

- Enameled Copper Winding Wires & Rectangular Strips

- Paper Insulated Copper/Aluminium Conductors

- Copper Busbars & PV Ribbons

- Fibre Glass Covered Conductors

- Over 8,000 SKUs (0.07mm to 25mm diameter)

Key Customers: Power Grid Corporation of India (pre-approved supplier), exports to USA (UL certified). Serves power transmission (48% revenue), electrical systems (29%), and general engineering (10%).

Manufacturing: 19,680 MT capacity expanding to 37,680 MT via new ALCU subsidiary unit.

Vidya Wires Financial Performance (₹ Crore)

Growth Highlights: Revenue +25% YoY, PAT +59% YoY in FY25. ROE 24.57%, ROCE 19.72%, Debt/Equity 0.88.

Peers: Precision Wires India, Ram Ratna Wires, Apar Industries.

Objects of Vidya Wires IPO Proceeds

Net fresh issue proceeds allocated as:

Promoter Holding: Pre-IPO 99.91% → Post-IPO dilution via small OFS (Shyamsundar Rathi, Shailesh Rathi).

Vidya Wires IPO Subscription Status (Live from Dec 3)

Monitor real-time Vidya Wires IPO Subscription on: IPO Ji Subscription Tracker

Expected strong QIB interest given power sector tailwinds and profitable track record.

Vidya Wires IPO FAQs

- What is the Vidya Wires IPO opening date?The Vidya Wires IPO opens on December 3, 2025, and closes on December 5, 2025, at 3:30 PM IST, with a UPI mandate cut-off at 5 PM on the final day.

- What is Vidya Wires IPO lot size?The lot size is 288 shares, requiring a minimum investment of ₹14,976 at the upper price band of ₹52 per share; retail investors can bid in multiples of this lot.

- What is Vidya Wires IPO price band?The price band is fixed at ₹48–₹52 per share for this book-built mainboard IPO of ₹300.01 crore, comprising ₹274 crore fresh issue and ₹26.01 crore offer for sale.

- Is Vidya Wires profitable? Yes, Vidya Wires is profitable with FY25 revenue of ₹1,491 crore and PAT of ₹40.9 crore, reflecting a 59% year-over-year growth, supporting its strong financial position ahead of listing.

- How to check Vidya Wires IPO allotment status?Post-allotment on December 8, 2025, check status via registrar MUFG Intime's website using PAN or application number, or use IPO Ji tracker and broker portals like Groww.

- What is Vidya Wires IPO listing date?Shares list on BSE and NSE on December 10, 2025, following refunds and demat credit on December 9.

Vidya Wires IPO - Quick Links

- Check Vidya Wires IPO Live Subscription

- Check Vidya Wires IPO GMP

- Check Vidya Wires IPO Allotment Status

- Check Vidya Wires IPO Details

December 2025 IPO Calendar: Vidya Wires joins Meesho and Aequs for blockbuster listings.

Disclaimer: This content is for educational purposes from RHP/SEBI filings. Not investment advice. Consult a financial advisor. Past performance no guarantee of future results.

Ready to Apply? Visit IPO Ji Vidya Wires IPO now! 🚀